Information-technology spending in Russia is expected to drop 39% this year as global business sanctions triggered by the invasion of Ukraine take their toll.

On Thursday, the U.S. Senate voted 100-0 to strip Russia of favored trade status and back President Biden’s Russian oil ban. The growing list of sanctions imposed by the U.S., the EU and other countries limits Russian access to a broad range of goods and services, including financial systems and certain kinds of technology. Tech giants including

Microsoft Corp.

,

Amazon.com Inc.’s

Amazon Web Services and

Alphabet Inc.’s

Google Cloud have said they are suspending new sales or the acceptance of new customers in Russia.

The sanctions will depress IT spending in Russia this year by an estimated 39%, or $12.1 billion, to $19.1 billion from the $31.2 billion forecast for 2021, according to researcher International Data Corp. IT leaders in Russia say they expect the sanctions will lead to widespread shortages of hardware and will introduce difficulties while they replace Western software with open source or locally developed alternatives.

In 2017, Russia mandated that majority state-owned enterprises needed to start weaning themselves off software from Western nations, but as of February 2022, many of these organizations were still heavily reliant on Western sources, according to IDC.

“Pretty much no one is expecting the sanctions to be lifted anytime [soon],” said

Oleg Aksenov,

a Moscow-based IT executive with 15 years of experience, including most recently as a division CTO at Russia’s largest bank,

and one of the leading members of a nonprofit group of Russian digital leaders. “Most everyone is just taking this as, this is a new reality. We are going to adapt to it. It’s going to be like the days of the Soviet Union,” he said.

Hardware spending will decline the most primarily due to lack of supply, said

Robert Farish,

IDC vice president and regional managing director for the market comprising the former Soviet Union. Going forward, the weakened ruble also will make imported hardware more expensive, which will in turn affect demand, he said.

Karen Kazaryan,

Moscow-based chief analyst of the Russian Association for Electronic Communications, said that there are Russian manufacturers of hardware, but their production is constrained by global supply-chain problems.

The war in Ukraine has disrupted the Russian hardware business, and foreign companies such as

Intel Corp.

and

are no longer supplying parts to Russian hardware companies, according to IDC’s Mr. Farish. “They’ve largely not been producing very much since the beginning of March,” he said.

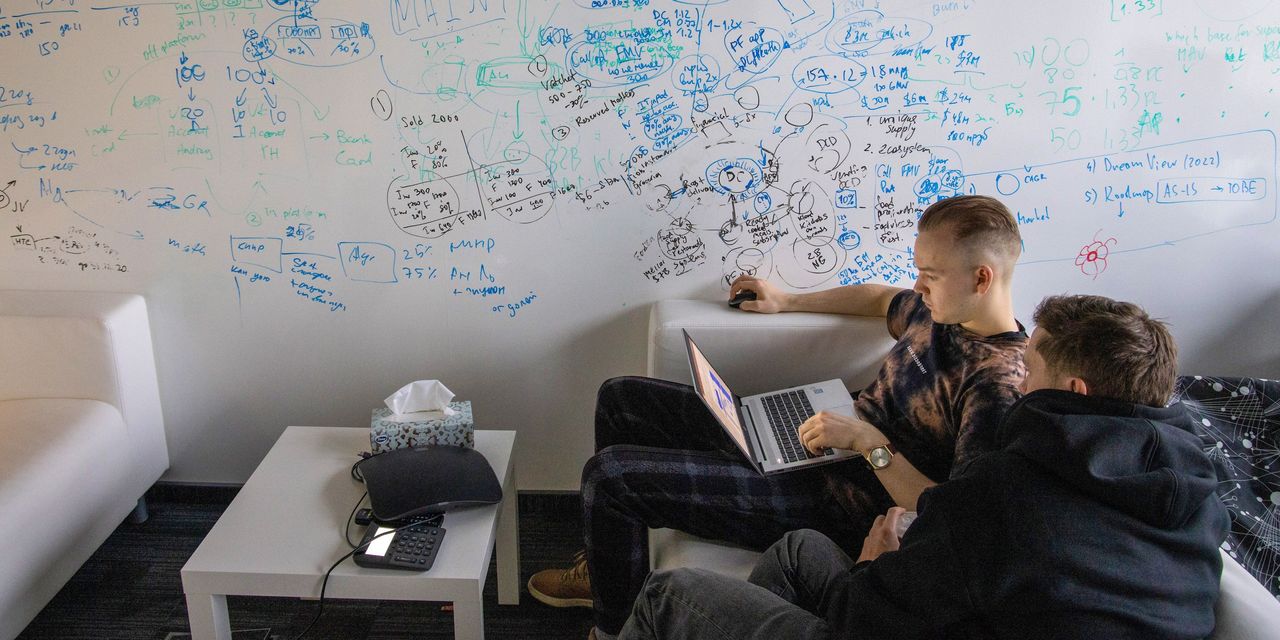

Photo:

Ivan Kozlov

Ivan Kozlov,

vice president of the St. Petersburg CIO Club, said large Russian companies have enough hardware stock for about eight months. Afterwards, he said, “We will see how it goes.”

Russian companies are turning to open source or locally developed alternatives to Western software subscriptions that won’t be renewed, according to Mr. Aksenov.

Russian alternatives include MyOffice, which has similarities to Microsoft 365, and 1C Co., which can duplicate some of the functions of SAP software, according to Mr. Farish, of IDC. Nonetheless, “the Russian software industry cannot cover all of the thousands of niches that exist in the global software industry,” he said.

Konstantin Grachev,

the deputy CIO of a 611-store grocery chain in Russia, said his company had to scrap plans to switch to Microsoft 365. He said the company is currently using Microsoft Windows 10 and Microsoft Office 16 on licenses it bought several years ago.

“We need to reinvent ways to work,” said Mr. Grachev, whose company roughly translates in English to “Good Choice.”

IDC estimates that Microsoft’s Azure Cloud is the largest cloud provider in Russia with a 17% market share, followed by Amazon Web Services with 14%.

Mr. Grachev said his company is transferring its data from Google Cloud to Russian cloud providers such as Yandex NV and VK Cloud Solutions.

Sberbank, Mr. Aksenov said, uses its own SberCloud, one of the larger local providers.

While the Western software services are still active, Mr. Farish said, Russian users now understand the enormous risk in using them since they could be blocked by the companies or the Russian government at any point.

In the long term, Russia will have to develop more of its own technology products, he said.

“Definitely this is crisis time,” Mr. Kozlov said, “[but] when someone leaves the market, there is always someone else who will take that place.”

Write to Isabelle Bousquette at Isabelle.Bousquette@wsj.com

Copyright ©2022 Dow Jones & Company, Inc. All Rights Reserved. 87990cbe856818d5eddac44c7b1cdeb8

24World Media does not take any responsibility of the information you see on this page. The content this page contains is from independent third-party content provider. If you have any concerns regarding the content, please free to write us here: contact@24worldmedia.com

Common Mistakes When Using Athletic Field Tarps

High-Performance Diesel Truck Upgrades You Should Consider

Warehouse Optimization Tips To Improve Performance

Fire Hazards in Daily Life: The Most Common Ignition Sources

Yellowstone’s Wolves: A Debate Over Their Role in the Park’s Ecosystem

Earth Day 2024: A Look at 3 Places Adapting Quickly to Fight Climate Change

Millions of Girls in Africa Will Miss HPV Shots After Merck Production Problem

This Lava Tube in Saudi Arabia Has Been a Human Refuge for 7,000 Years

Four Wild Ways to Save the Koala (That Just Might Work)

National Academy Asks Court to Strip Sackler Name From Endowment

Ways Industrial Copper Helps Energy Production

The Ins and Out of Industrial Conveyor Belts