A year ago, speculative stocks such as

GameStop Corp.

were some of the most-favored choices of individual investors. Since then, though, their tastes have changed.

Retail investors’ top picks now look more like they did in early 2020, when the roster of the most-popular U.S.-listed stocks and exchange-traded funds was made up almost entirely of shares of well-established companies in the benchmark S&P 500 and ETFs representing broad bets on U.S. stocks or bonds, according to data from VandaTrack.

As the pandemic progressed through 2020 and then 2021, shares of electric-vehicle companies and meme stocks popular on social media were among those that broke into the list of investments most popular with individual investors. More recently, though, those investors seem to be returning to traditional bets.

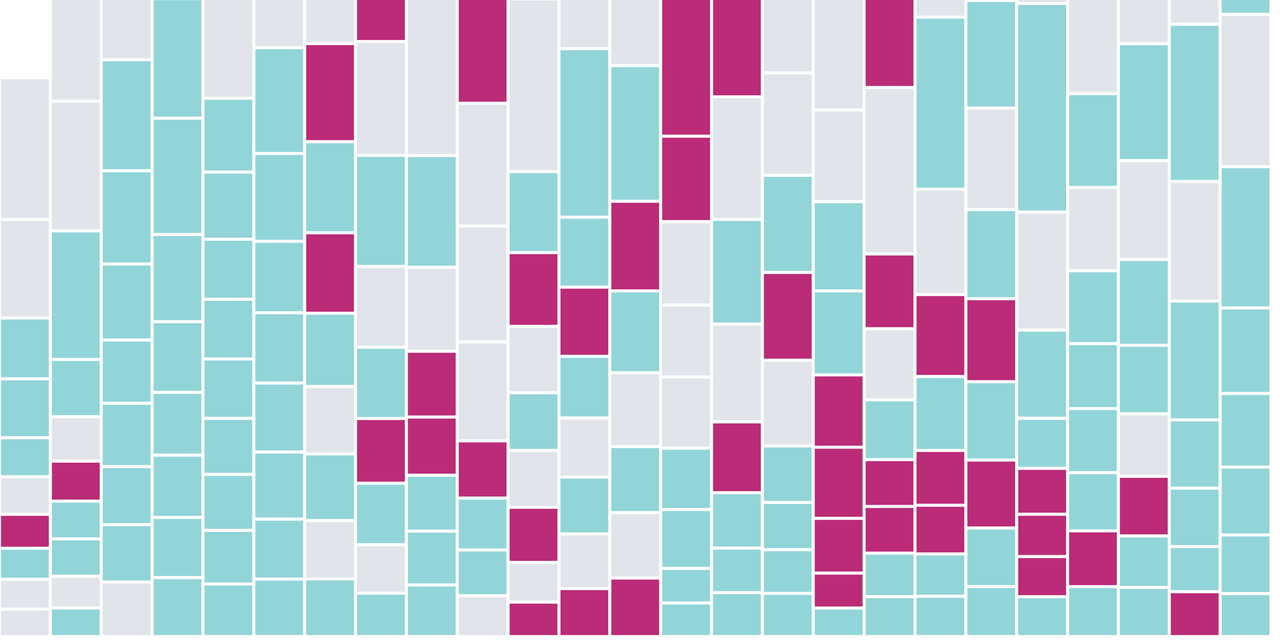

This chart shows the 10 U.S.-listed stocks and ETFs with the largest net purchases each month by global retail investors. Net purchases are calculated by taking the dollar value of purchases and subtracting the dollar value of sales.

For much of the past two years, the top spot has been shared by two broad-based ETFs. But for 10 months in the middle, Apple, the biggest U.S. company by market value, traded the lead with Chinese electric-vehicle maker NIO.

NIO was among several EV and EV-related companies that attracted individual investors, a list also including Tesla, Plug Power and Lucid. Tesla appeared in the top-10 list both before and since it was added to the S&P 500 in December 2020.

GameStop has cracked the top 10 just once in the past two years. That was in January 2021, when retail investors snapped up a net $410 million of the shares. Shares of the videogame retailer soared from less than $19 at the end of 2020 to $325 one month later—a 1,625% gain.

Cinema chain AMC Entertainment, another favorite of investors who spent time in social media forums, was a popular play in the spring and summer of 2021.

The airline and cruise industries were hit hard by the Covid-19 pandemic. Retail investors looked to buy the dip. In April 2020, they piled into shares of Delta Air Lines, United Airlines, American Airlines and Carnival.

This year through Jan. 27, the top-two spots are once again held by ETFs, while large-cap regulars Apple and Advanced Micro Devices also appear in the top five. If the current trend holds, it will be the first month since June 2020 that the top-10 net purchases did not include a single non-S&P 500 stock.

Write to Peter Santilli at peter.santilli@wsj.com and Karen Langley at karen.langley@wsj.com

Copyright ©2022 Dow Jones & Company, Inc. All Rights Reserved. 87990cbe856818d5eddac44c7b1cdeb8