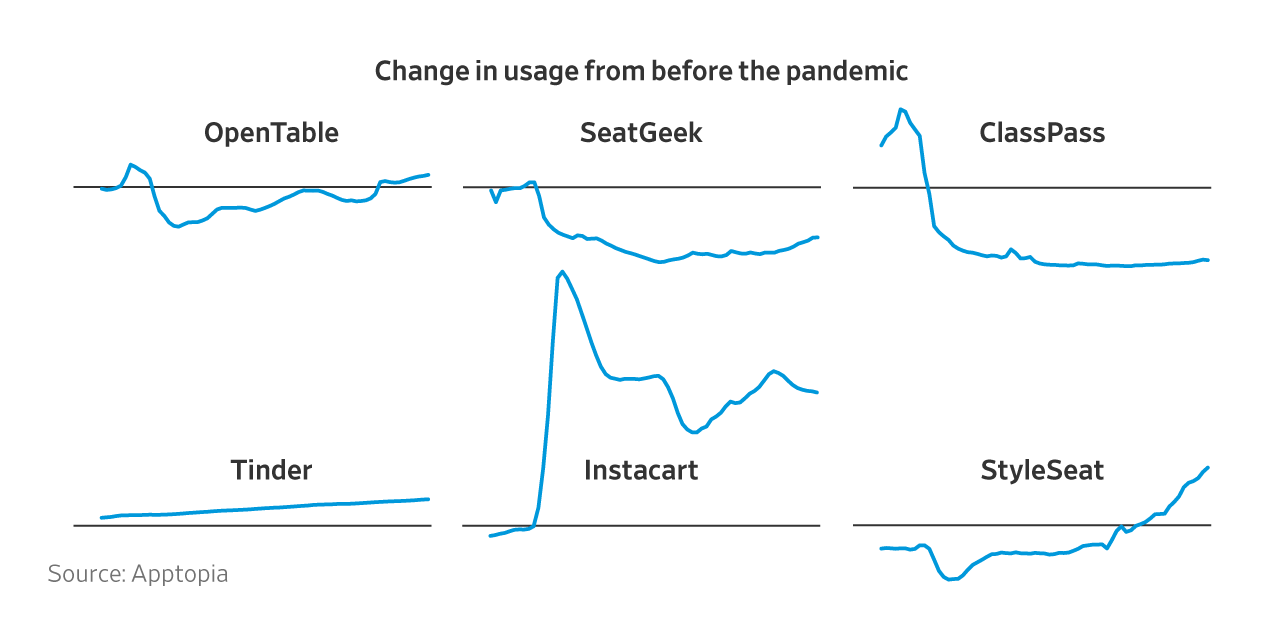

As more Americans are vaccinated against Covid-19 and as rules on social distancing are relaxed, interest in activities such as travel and live entertainment is starting to recover, new data on app usage suggest.

Trends seen from a range of sources, including information on active users of a variety of consumer apps as estimated by the data tracker Apptopia, indicate that those factors, along with warming weather, federal aid dollars and a general desire to get out of the house, are helping some consumer and social activities approach pre-pandemic levels.

We are eating out again…

Daily users of the restaurant reservation app OpenTable more than doubled in mid-April from the same time a year earlier as state and local restrictions on indoor dining and drinking eased.

In March, according to Census Bureau data, sales at eating and drinking places rose 36% from their 2020 level, while total retail sales were up 9.8%. During the first week of April, 45% of Americans said they had dined out, up from 29% in early February, according to the pollster Ipsos. Demand is even higher for outdoor dining. According to a recent poll from the data-intelligence firm Morning Consult, 68% of U.S. adults said they felt safe sitting down for a meal outside.

…but we are still ordering meals and groceries more than we did before the pandemic

Americans are continuing to use restaurant and grocery delivery services well above levels before the pandemic, according to Earnest Research.

Spending at casual-dining establishments rose 32% between February and March, according to Earnest, and climbed 27% at fast-casual restaurants. Online grocers’ sales rose 12%, compared with a 9% boost for meal kits. Cooking at home has remained popular, with many Americans still working from home or looking to save money.

“We believed all along that consumers’ increased demand for convenience would continue post-pandemic, and it’s playing out that way,” said

Wyman Roberts,

chief executive officer of Chili’s and Maggiano’s Little Italy owner

on a conference call this week. “We expect that when things normalize, we’ll see stronger dining rooms and a takeout and delivery business stronger than it was pre-pandemic.”

Daily active users by week, change from 2019 annual average

Foot traffic at casual dining and quick-service restaurants rose more than 30% between February and March, according to Earnest. In both categories, it is now roughly at or near January 2020 levels.

“People are going to start going back to restaurants,” said Linda Findley Kozlowski, CEO of meal-kit company

Blue Apron Holdings Inc.,

at a March investment conference. “People are going to start socializing again—probably slower than any of us would like, but they are going to start doing that. We want to fit into that new lifestyle and bring those experiences together.”

We are slowly returning to entertainment venues

As the U.S. shut down in March 2020, in-person entertainment came to a standstill. After plummeting, activity on ticket-purchasing apps is ticking up again as authorities increase the allowable capacity of venues for sports, music and other forms of entertainment. It remains below 50% of pre-pandemic levels.

Some states are developing vaccine passports that might offer businesses a way to determine whether a customer has been vaccinated. Others won’t. New guidance from the Centers for Disease Control and Prevention says that fully vaccinated individuals should still wear face masks at large outdoor events.

Daily active users by week, change from 2019 annual average

Julia Hartz,

CEO of ticketing site

expects consumers to return to big events gradually.

“It’s going to be, at first, very hyperlocal,” she said at a March investor conference. “People are going to take their nuclear pod, and they’re going to expand a little bit, and it’s going to ease back in. I think that you’ll see a proliferation of small local events happening at much, much greater volumes in 2021, really giving rise to larger events in 2022.”

We are eager to start traveling again…

As the idea of going on vacation dimmed during the first months of the pandemic, activity levels on travel apps dipped below their 2019 averages. Over the past year, travel planning has slowly grown, rising to well above pre-pandemic levels in recent months.

Pent-up demand for travel has led airlines to increase the number of routes within the U.S. and overseas.

expects to reach 90% of its domestic pre-pandemic capacity this summer.

Daily active users by week, change from 2019 annual average

“Even in the pandemic, we had still about 60% of the volume in the fourth quarter of people looking at our site that were there before, looking ahead, looking where they could go thereafter,”

Tripadvisor Inc.

CEO

Ernst Teunissen

said at a March investor conference. “More people are looking ahead toward their next vacation. So we think there’s quite a bit of pent-up demand, and that puts us in a good spot with some optimism for 2021.”

Consumers aren’t only returning to travel planning—some are actually on the move. Foot traffic at airports and lodgings rose more than 40% between February and March, according to Earnest.

…and we might be more likely to take an RV vacation than a luxury cruise

With hotels closed, Americans last summer rented recreational vehicles to get away. Usage data from RV Parky, a digital directory of RV parks, indicates that the trend might continue. App usage suggests a sustained consumer wariness regarding cruise ships as the U.S. industry awaits a go-ahead from the federal government.

We are still very much dating

Last year online dating became pretty much all dating, and some apps teased users with new functionalities such as in-app video. The trend started before the pandemic and is expected to stay. The largest dating apps in the U.S. saw a 13% year-over-year increase in monthly active users in the final quarter of 2020, the biggest such jump in nearly two years.

Daily active users by week, change from 2019 annual average

Match Group Inc.

executives said on a February conference call that the company’s outlook for the second half of 2021 didn’t assume a full return to normalcy.

“It’s certainly possible that that could happen,” said Chief Financial Officer Gary Swidler. “I know there are people who believe that’s what’s going to happen.”

Meanwhile, users of the Meetup app, a tool for finding nearby events, friends and activities, remain well below pre-pandemic levels.

We might return to the gym, but we aren’t abandoning digital workouts

Are people moving from home workouts back to bricks-and-mortar gyms? The use of apps related to exercise equipment—such as the gear from the exercise-bike company

Peloton Interactive Inc.

and other platforms featuring guided routines to follow from home—saw usage jump during the pandemic. (Peloton’s app can be used by those who don’t own its bikes.)

Apps for gym members, such as Blink Fitness, are beginning to see a comeback; Blink’s app also offers virtual classes and video coaching. Foot traffic at gyms rose 26% between February and March, according to Earnest data; spending climbed 8% during the same period.

Analysts and executives expect the fitness business to increasingly become a mixture of digital and bricks-and-mortar offerings.

“People have found a way not only to replicate exercising outside of the home, but enjoy it more and perhaps are doing it even more than they were even pre-pandemic,” said Peloton CFO

Jill Woodworth

at a March conference. “So I feel like this is a trend that’s here to stay. Covid just accelerated that trend.”

Daily active users by week, change from 2019 annual average

We are done cutting our own hair

Salon appointments for hair, nail and other elements of personal care are back, with consumers leaving behind the DIY approaches they embraced earlier in the pandemic.

Users of StyleSeat, an app for booking beauty appointments, are up more than 50% from their 2019 average.

—Design and development by Juanje Gómez

Write to David Marino-Nachison at david.marino-nachison@wsj.com, Ana Rivas at ana.rivas@wsj.com and Max Rust at max.rust@dowjones.com

Copyright ©2020 Dow Jones & Company, Inc. All Rights Reserved. 87990cbe856818d5eddac44c7b1cdeb8

24World Media does not take any responsibility of the information you see on this page. The content this page contains is from independent third-party content provider. If you have any concerns regarding the content, please free to write us here: contact@24worldmedia.com

Common Mistakes When Using Athletic Field Tarps

High-Performance Diesel Truck Upgrades You Should Consider

Warehouse Optimization Tips To Improve Performance

Fire Hazards in Daily Life: The Most Common Ignition Sources

Yellowstone’s Wolves: A Debate Over Their Role in the Park’s Ecosystem

Earth Day 2024: A Look at 3 Places Adapting Quickly to Fight Climate Change

Millions of Girls in Africa Will Miss HPV Shots After Merck Production Problem

This Lava Tube in Saudi Arabia Has Been a Human Refuge for 7,000 Years

Four Wild Ways to Save the Koala (That Just Might Work)

National Academy Asks Court to Strip Sackler Name From Endowment

Ways Industrial Copper Helps Energy Production

The Ins and Out of Industrial Conveyor Belts