One of the biggest names in cryptocurrencies is betting on individual investors.

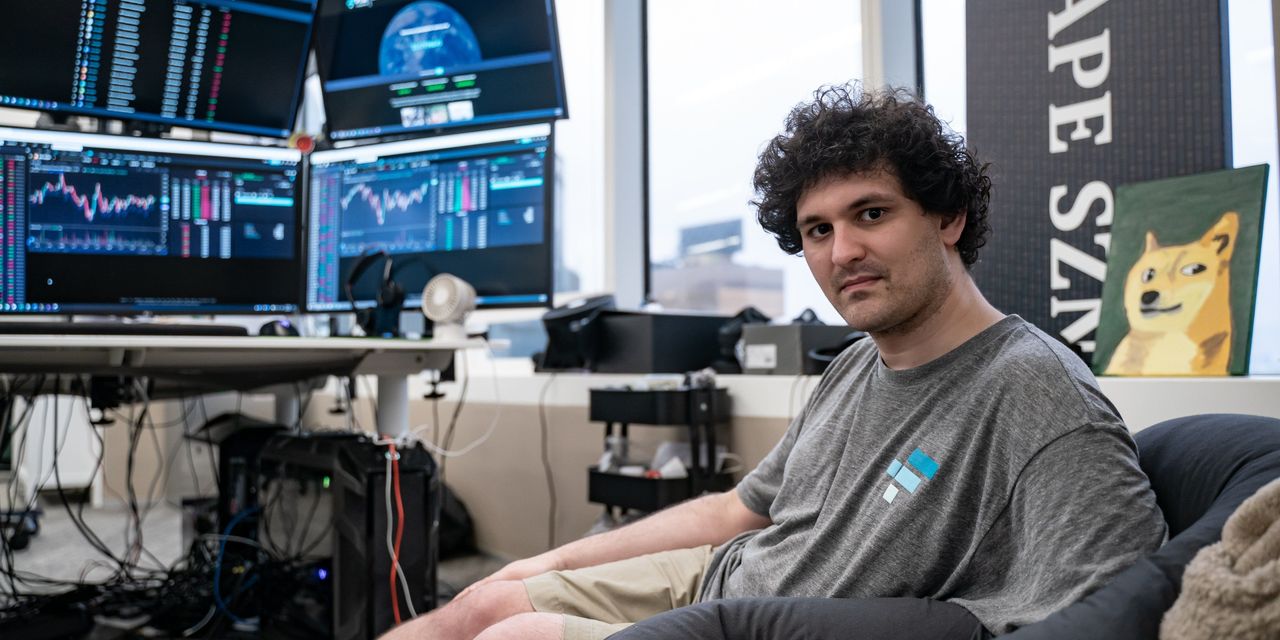

Sam Bankman-Fried,

the 30-year-old billionaire who founded the cryptocurrency exchange FTX, bought a 7.6% stake in

Robinhood Markets Inc.,

according to a Thursday regulatory filing. He paid about $648 million for the stake, which would make him the trading app’s third-largest shareholder.

Mr. Bankman-Fried’s shares are worth around $482 million based on Thursday’s closing price of $8.56. Shares of Robinhood jumped as much as 42% in after-hours trading.

Robinhood is an “attractive investment,” Mr. Bankman-Fried said in the regulatory filing.

“We think it is an attractive investment, too,” Robinhood said in a statement.

Mr. Bankman-Fried disclosed the purchase via a 13D form, which investors use when they plan to take an active role—perhaps by seeking board seats or agitating for a sale. Mr. Bankman-Fried said he has no plans to do those things right now, but he didn’t rule them out.

Investors looking to buy more shares, or perhaps even take control of a company, typically make their presence known using 13D forms. But a Robinhood takeover bid could face formidable challenges. Its founders have more than 60% voting control and, according to a person familiar with the matter, are focused on keeping the company independent as they build it. What’s more, Robinhood stock is down nearly 80% from its July initial public offering price of $38.

The purchase comes at a challenging time for both Robinhood and crypto.

Robinhood added millions of users last year when small-time investors flocked to the stock market. But it has struggled to keep them; monthly active users fell 10% to 15.9 million in March, from 17.7 million in the same month of 2021. Robinhood laid off 9% of its employees late last month.

Cryptocurrencies have plunged recently, a consequence of investors’ reluctance to hold risky assets at a time when the Federal Reserve is moving aggressively to curb inflation. A crash in the price of a key stablecoin pegged to the dollar also roiled the market. Bitcoin fell to its lowest level since December 2020 on Thursday.

Mr. Bankman-Fried’s crypto exchange, FTX, allows traders to make an array of bets, including how stocks will trade after they go public or whether

will win a second term as president in 2024. An October funding round valued the company at $25 billion.

Robinhood has expanded its crypto offerings in recent months, adding four new tokens to the platform last month. It has offered crypto trading since early 2018.

—Dana Cimilluca contributed to this article.

Write to Orla McCaffrey at orla.mccaffrey@wsj.com

Copyright ©2022 Dow Jones & Company, Inc. All Rights Reserved. 87990cbe856818d5eddac44c7b1cdeb8

24World Media does not take any responsibility of the information you see on this page. The content this page contains is from independent third-party content provider. If you have any concerns regarding the content, please free to write us here: contact@24worldmedia.com

Common Mistakes When Using Athletic Field Tarps

High-Performance Diesel Truck Upgrades You Should Consider

Warehouse Optimization Tips To Improve Performance

Fire Hazards in Daily Life: The Most Common Ignition Sources

Yellowstone’s Wolves: A Debate Over Their Role in the Park’s Ecosystem

Earth Day 2024: A Look at 3 Places Adapting Quickly to Fight Climate Change

Millions of Girls in Africa Will Miss HPV Shots After Merck Production Problem

This Lava Tube in Saudi Arabia Has Been a Human Refuge for 7,000 Years

Four Wild Ways to Save the Koala (That Just Might Work)

National Academy Asks Court to Strip Sackler Name From Endowment

Ways Industrial Copper Helps Energy Production

The Ins and Out of Industrial Conveyor Belts