Today, there are countless places and people you can get a loan from. You can go to conventional banks and credit unions for the necessary credit access. But these traditional options can be demanding. On the more modern side, there are cash apps and cryptocurrency options. But with such choices, your safety and security could be at risk. The question is, “Where can you find reliable loans that best fit your cash emergency needs?”.

We have listed the top 4 places to get instant payday loans online with guaranteed approval. We have done stringent background checks and vouch for their reliability. Inspect each of our recommendations to discover the best one for you. We have also answered your questions about payday loans for extra guidance.

List of the Best Instant Payday Loans Online With Guaranteed Approval Companies

So here’s finally, our top pick of payday loan sites you can find online:

Review of the Top Payday Loan Lenders

#1. AdvanceSOS: Best for Cash Advance Online

AdvanceSOS is our #1 pick as the most reliable provider of cash advance loans online. The payday loans company is a pioneer in developing loan products for borrowers of all kinds. From instant cash loans to bad credit cash advances, AdvanceSOS has it all. The company’s inclusive brand extends credit to everyone who needs it.

AdvanceSOS is a well-established payday loan online aggregation service provider. Over the years, the company has built its network of trusted financing partners. All their lenders follow strict federal and state regulations. So they are all licensed and assure your safety while using their platform.

AdvanceSOS’ primary selling point is the environment the company maintains for customers. Since 2019, the company has had a safe and easy-to-use online platform. Anyone curious about getting a payday loan from AdvanceSOS can visit the company’s online portal and see how easy it is.

AdvanceSOS customers enjoy the journey of borrowing with the company. With this remarked feature in mind, the company has worked further to improve the ease of use of their services. And the fruits of their labors show in the circle of satisfied customers growing around them.

Amanda Girard, the lead financial writer of AdvanceSOS, said in a closed interview:

“AdvanceSOS centers its company goals and actions on serving the most under-served Americans today. We know the gap exists between credit and those who need credit the most – we’re working day in and day out to narrow this gap.”

Girard also shared in her interview how she is proud to be a vital part of AdvanceSOS. She was excited to reveal that their company is working on further improving customer experience using their online loan portal.

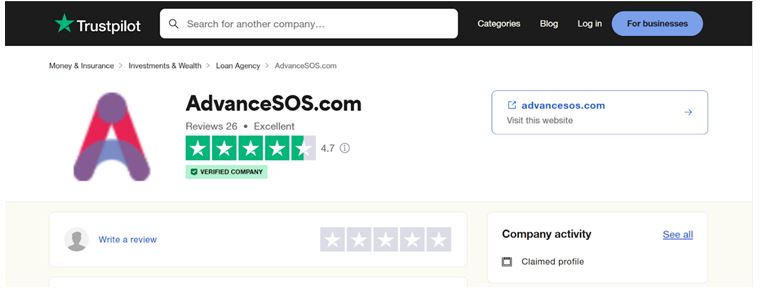

Quality Rating: 4.7/5 ⭐

From TrustPilot, AdvanceSOS received a TrustScore of 4.7 out of 5 from the review of 26 respondents. As of May 2023, the Verified Company badge is decorating its page. Said badge is a testament to the company’s reputation since its establishment.

The business’s quick funding and low credit score restrictions were in the reviews. Many clients were shocked that they could still secure great loan offers despite having poor credit or unemployment. Most of them also expressed their thanks for how the quick cash loans helped them out of trouble.

Find out below what AdvanceSOS’s prior clients have to say about the business:

Remarkable Features

Same Day Approval

Choose AdvanceSOS and secure same day approval loans in less than 24 hours. Apply online through their online portal to get instant approval. Processing for direct deposit of your loan concludes on the same business day.

No Hard Credit Check

A hard credit check in search of financial dirt is not part of the approval process of AdvanceSOS. Skipping such a time-consuming step saves you and your lender time. Instead of hearing back from your lenders after days, get guaranteed approval for your loan in hours.

Bad Credit OK

With AdvanceSOS, however much (up to $1,000) you need for your small cash emergency, you don’t have to worry about your credit status. You can have bad credit (even no credit), and the company will not take it against you. They offer equal opportunities for everyone for bad credit guaranteed approval.

#2. PaydayBears: Best for Short Term Loans

PaydayBears is our second pick for instant payday loans online with guaranteed approval. Despite being the newest on this list, the company has already made a name for being a reliable provider of quick payday loans. With this, customers warmed up fast to the brand. A handful of customers have formed an opinion on how they admire the company treating their financial needs like family would.

The brand focus of PaydayBears is understanding that everyone goes through tough times. It’s their mission to help customers handle better when emergencies challenge their finances. Their goal is simple – hand customers high-quality loan deals with fast funding with ease. They even go the extra mile of extending help to borrowers most other financial institutions would turn away.

Established by finance industry experts, PaydayBears has a bright future in only securing its position in the US. Their network of modern partner lender-investors gives them an edge in offering payday loans geared with top features. PaydayBears raises loan funds fast, even for minimum-requirement requests. So customers are assured of having a high chance of bagging the small-dollar loan they need.

And since the company is customer-centered, they check your situation throughout your loan journey. Before you complete a loan deal, they have a Financial Blog section on their website where you can find guidance. While negotiating your loan deal, the company mediates your needs with lenders. Even if you don’t know how to borrow, PaydayBears will assist you in ensuring you have fair loan terms. And finally, after you finish your loan deal, PaydayBears still have your back with their 24/7 Customer Service.

To quote the company’s lead financial content strategist and writer:

“Here at PaydayBears, we work to spread the warmth of personal financial security through short-term loans. All teams chip in with ideas on making short-term loans the blanket against the coldness of financial insecurity. ”

Quality Rating: 4.7/5⭐

PaydayBear’sTrustPilot page has excellent customer ratings of at least 4.6. Reviews for the company commend it for having quality products only for customers. Customer service is also one of their best qualities, as they take care of their customers anytime, 24/7.

Among the many excellent ratings left by recent customers of PaydayBears, is a mother of three from Alabama. She expressed her thanks after she secured aDespitedvance on the same day. The mother recalled that she did not have to prepare much to apply and secure her PaydayBears payday loan, and for that, she was relieved.

To find out more about what users thought of PaydayBears, see the breakdown of the following quality indicators below:

Remarkable Features

Same Day Deposit

Receive and be able to use your loan’s funding on the same day with PaydayBears. The company has a fortified system for same-day loans, where you can get cash in less than 24 hours. Share only your complete bank information to receive offers for fast loans without delay.

Bad Credit Welcome

PaydayBears does not discriminate against its customers for the kind of credit they have. The company has built a reputation for accommodating borrowers from various backgrounds. So you can be confident in approaching the company for top-tier instant loans.

Quick Help in Emergencies

With PaydayBears and their quick-to-encash loan offers, rest assured you can immediately attend to any emergency. The company caters to customers wanting to be comforted with an early paycheck.

#3. MoneyZap: Best for Borrowing Money Online

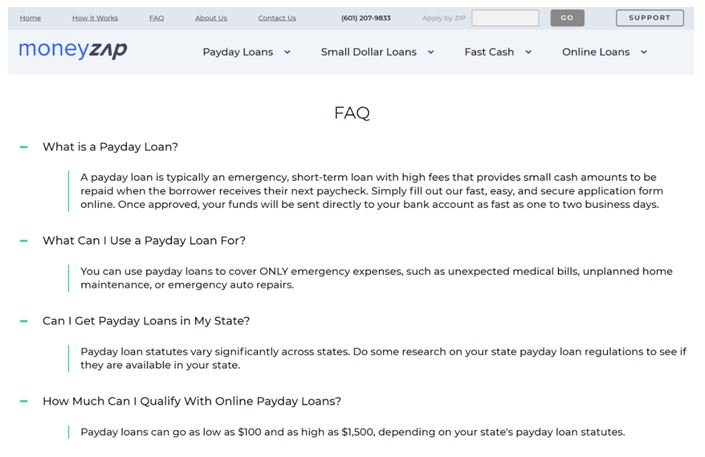

MoneyZap makes it to our list of top providers of instant payday loans online. Founded in 2021 by personal loans expert Dan Carpenter, MoneyZap is an excellent company. The company features a simple interface greeting customers looking only for high-quality options.

MoneyZap’s verification as a strong online payday loans aggregator allowing for fast cash borrowing made the news. Customers access top loan deals in all US through the power of the company’s online portal powered by Artificial Intelligence. At the get-go, share only your target loan amount and repayment term and already have a loan request.

MoneyZap offers instant cash online as they believe everyone deserves the chance for a loan in times of need. With them, anyone who needs money can borrow the amount they need for a small-dollar emergency. You can apply for his MoneyZap loan from home, work, or wherever you use only your mobile phone or computer.

Based on their qualifications, MoneyZap matches borrowers to any of the following loan options:

According to the company’s ‘About Us’ section online, its primary goal is to “empower consumers to control their finances.” The company does this by pursuing the online integrity of lending. They make borrowing and information about it more accessible to the general public. The company understands how hard it can be for most borrowers to find a reliable source of loans. But they are making headway with their initiative of pushing an informational drive for payday loans through its ‘Blog’ section. Check out the company’s website if you’re interested.

Frank Glemstone, lead content author and personal loans expert, said in our exclusive interview:

“Ease of use is what separates us from the rest of our competitors. We know how to serve customer-borrowers online without needing them to move an inch. With our high-end online capabilities, we proudly say that we serve EVERYONE without discrimination.”

Quality Rating: 4.6/5⭐

As of May 2022, MoneyZap’sTrustpilot site is filled only will 5-star reviews from verified customers. The latest 5-star review left on the site by George Edwin appreciates how the company “went above and beyond to secure the funding I required…” Meanwhile, the rest of the three reviews further noted the speediness of the company’s services. Reliability to having products on hand was also a feature applauded in some studies.

To learn more about what certain past users thought about MoneyZap, see the list below:

Remarkable Features

Money ASAP

Wanting to have cash as soon as possible is an impossible task. But not for MoneyZap. Armed and ready with partner lenders who have money on hand to lend you, be able to secure funding ASAP. Never again make your bills wait with a loan from this company.

Money Instantly

Get money into your bank account on the same day with MoneyZap. Ensure you apply early and receive your loan funding by the afternoon. Have cash on hand in an instant with MoneyZap.

Money for Bad Credit

Need better credit and still be able to borrow money online with MoneyZap. Never again worry that you’re not worthy of credit only because you have a credit rating. Apply using the company’s simple method online and get payday loans no credit check.

#4. DirectLoanTransfer: Best for People With Bad Credit

Our last, but not the least pick for payday loans in 2023 is DirectLoanTransfer, a bad credit-centered loan aggregation company. The company was founded in 2020 by the country’s top personal finance experts. It serves the needs of cash-needing Americans unserved by traditional lenders. They focus on offering an extensive catalog of short and long-term loans for payday loans bad credit borrowers. But all credit types are welcome at the company’s doors as well.

The company’s primary mission is to help clients of all backgrounds get the funds they need. The company is dead set on extending credit opportunities to the people denied of them most. They focus on enabling borrowers with bad credit to have financial options when needed. The company symbolizes the safety net every American has should they need cash fast.

Soft credit checks and relaxed requirements were the company’s ideas for inclusiveness. Using its latest advancements, the company has succeeded in giving loans to even the most desperate borrowers. Even without credit, they made the impossible possible. It also lends to borrowers bad credit guaranteed loans despite having poor credit.

We vouch for DirectLoanTransfer as a reliable credit-linking service. Applying for a short-term loan online from the company is a quick and easy process because of their online prowess. And even with a low credit rating, you’re more likely to get solid approval from them. As such, the platform makes it easier for people who have never taken a loan before to get a loan. Their website is also simple and intuitive. And as a bonus, the site provides valuable info about:

Quoting Kyle Drummond, the financial content strategist of DirectLoanTransfer:

“Inclusivity is the goal of DirectLoanTransfer as a loans aggregator. By pre-approving borrowers, we convince lenders to give them loan offers regardless of their credit status. This extra, short-to-do step increases the chances of borrowers for top-tier deals by working with us.”

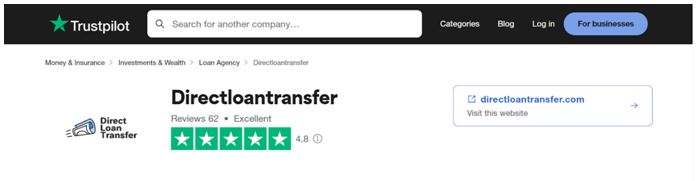

Quality Rating: 4.8/5⭐

A 4.8 out of 5 TrustScore was awarded to DirectLoanTransfer by TrustPilot. The 62 reviews of the company since 2020 translated into an ‘Excellent’ quality rating. Top reviews for the company appreciated the selection of loans for all credit types. Many of them shared that regardless of their finances, they accessed various loans fast.

Check out the breakdown of what previous users had to say about DirectLoanTransfer below:

Remarkable Features

Easy & Quick Form

With DirectLoanTransfer, skip the hassle of filling up piles of paperwork to apply for a loan. Use only the form they have on their online portal. Supply only the info the form asks of you in 10-15 minutes and already have your request sent to all their lenders.

Fast Approval for Small Amounts

Because the company specializes in bad credit loans, they approve small payday loans online no credit check fast. So if you are looking for a loan between $100 and $500, this company is your best bet to secure the cash you need ASAP.

Direct Deposit

Get the direct deposit you need for your emergency into your bank account the fastest with DirectLoansTransfer. With a quick application and almost instant approval, be able to remedy your crisis right away.

What Are Instant Payday Loans Online With Guaranteed Approval?

Instant payday loans online with guaranteed approval are short-term immediate cash loans. These loans are also known as payday advance loans or cash advance loans. Most of the time, borrowers use this loan type for emergencies that need a little cash fast. Minor medical bills, urgent car repairs, and home improvements are some of the most common reasons to borrow payday advances.

How Do Instant Payday Loans Online With Guaranteed Approval Work?

Instant payday loans online guaranteed approval are easy-to-get loans with simple requirements. So the key to getting one is ensuring you nail in having a few pieces of information and documents. Once you have everything, go to the online portal of the loan provider of your choice. Supply the info the portal will ask you, which usually only takes 10-15 minutes to give. After completing their online form, click ‘OK’ or ‘Apply Now.’

In2-3 hours, receive your top loan deal. Click the link to your lender’s deal and see its complete details. Check for the specifics such as the loan amount, due date, and interest rate. Compare said details to your needs and determine if it’s the loan for you. If the loan is okay, attach your electronic signature to your loan contract to finish it.

In 24-48 hours, check your bank account for your loan funding. Ensure that you receive the correct amount from your lender. Once you clear it, you are free to use your new funds for whatever purpose you have in mind for it. There are no limits or restrictions.

In 2-4 weeks, depending on your loan agreement, repay your loan plus interest. Most of the time, your bank will send a pre-scheduled payment to your lender on the due date. So ensure that your account contains your payable amount before the due date to avoid a penalty.

If you cannot repay your lender as promised, brace yourself for the consequences. It’s best to contact your lender when you think you can’t make it. Reach an amenable alternative plan to make do with your obligation without high fees.

What Do I Need To Apply For Instant Payday Loans Online With Guaranteed Approval?

The first thing you need to know is what you don’t need to apply and qualify for payday loans:

Instead, here are the eligibility requirements and the accompanying documents you will need. Ensure that you pass the basic eligibility requirements first. Then, have your supporting documents ready by the time of your application to heighten your instant loan approval chances.

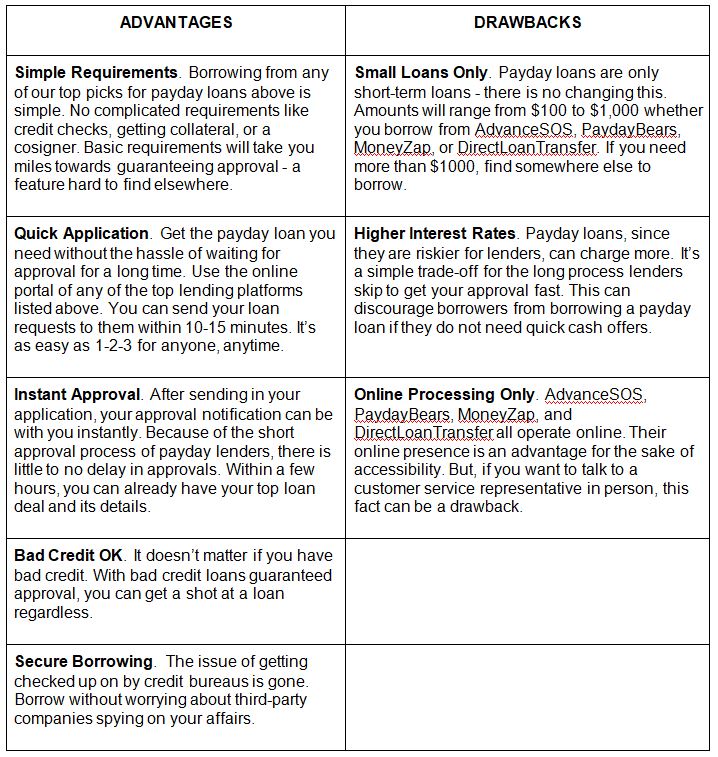

What Are the Advantages and Drawbacks of Instant Payday Loans Online With Guaranteed Approval?

Instant payday loans online with guaranteed approval have their pros and cons. Like any other, there are things to like and hate about such financial products. How these advantages and drawbacks weigh into your decision to get one depends on what you need. So look at what this product and service offers you and discover if it’s what you need.

Knowing that the other end of your loan stick can be trusted is always essential. After all, it’s your lender’s terms that you will have to accept at the end of the day. And the reasonableness of your lender can make or break your financial future.

Only ever apply and accept loans from lenders you know you can trust. Look for referrals or customer feedback using independent review sites like TrustPilot. These resources will ensure that the lender you make a deal with has had only great deals with borrowers like you before.

Tip 2: Ensure Your Qualifications Meets Your Lender’s Requirements

There are five things you need to consider with this tip:

How Much Are Instant Payday Loans Online With Guaranteed Approval?

Payday loans cost, on average, $15 per $100 every two weeks. In Annual Percentage Rate (APR) terms, this is around 395%. So for $255 payday loans online the same day, you will have to pay more or less $38.25 for holding it for two weeks.

Compared to other loans, the APR for payday loans is higher. But, financial advisors always caution borrowers to take APRs with a grain of salt. This is because APRs assume you will hold the loan for a year. This idea is the reason why interest stacks up to a three-digit number. But payday loans only last for weeks. So using APR is an unrealistic way of measuring how much you’ll have to pay for your payday loan.

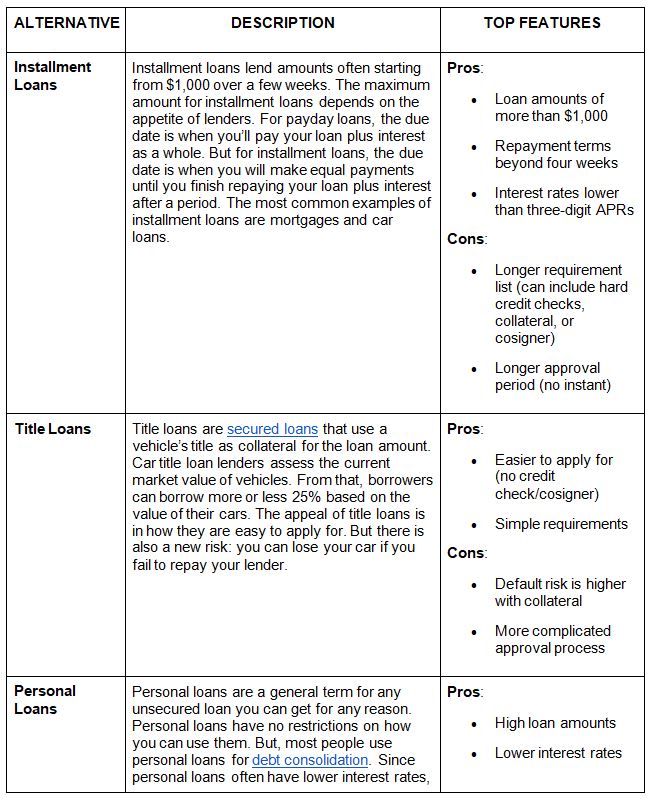

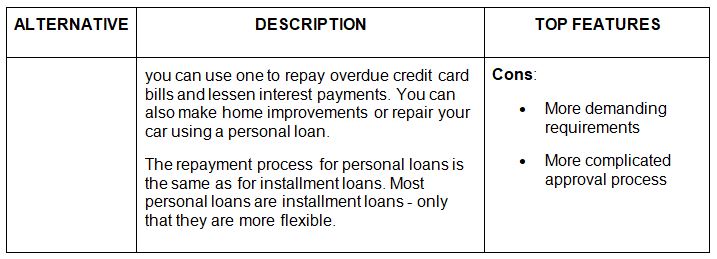

If Not Instant Payday Loans Online With Guaranteed Approval, What Are My Alternatives?

Like any financial product, instant payday loans online are not one-size-fits-all. Its best features may not be the items you’re looking for on your priority list. Whether you need a higher loan amount, lower APR, or more flexible terms, that’s okay.

We have top-level suggestions for you on what you can get instead of payday loans. Match your needs and other capacities to them below. We have also included descriptions and listed the top features for each alternative to help you with your decision.

Frequently Asked Questions (FAQs)

Can I Get Instant Payday Loans Online With Guaranteed Approval With Bad Credit?

Yes. AdvanceSOS, PaydayBears, MoneyZap, and DirectLoanTransfer all have online payday loans for bad credit. Apply with any of our top payday loan providers’ top picks, and do not worry about your credit status. You can have the worst or no credit and still get great deals from any of them. Ensure you have their basic requirements and are good to go.

Can I Get Instant Payday Loans Online With Guaranteed Approval With No Credit Check?

Yes, you can get instant loan approval with no credit check from AdvanceSOS, PaydayBears, MoneyZap, and DirectLoanTransfer. Your inquiry and application will not be shared with any credit reporting bureaus. So rest assured that your transactions are secured when you apply with any of our top payday loan picks.

Can I Get Instant Payday Loans Online With Guaranteed Approval With Instant Approval?

Yes, instant approval is a common feature among AdvanceSOS, PaydayBears, MoneyZap, and DirectLoanTransfer. Apply only with complete information, requirements, and documents. Loan approval will be with you instantly when you submit and clear your loan contract.

Can I Get Instant Payday Loans Online With Guaranteed Approval With Same Day Deposit?

Yes. Our payday loan top picks (AdvanceSOS, PaydayBears, MoneyZap, and DirectLoanTransfer) have same-day deposits. They offer instant payday loans online with guaranteed approval in less than a day. So you can get payday loans online same day deposit into your bank account before any business day ends.

A third-party advertiser sponsors this article. Please do not take any of the information above as professional financial advice. Do independent research into the products and services they wish to avail. Particularly for non-US, they may have different safeguards. Engage said companies with caution and ensure their credibility first. Visit the Securities and Exchange Commission for information on investments and financial regulations.

24World Media does not take any responsibility of the information you see on this page. The content this page contains is from independent third-party content provider. If you have any concerns regarding the content, please free to write us here: contact@24worldmedia.com

Common Mistakes When Using Athletic Field Tarps

High-Performance Diesel Truck Upgrades You Should Consider

Warehouse Optimization Tips To Improve Performance

Fire Hazards in Daily Life: The Most Common Ignition Sources

Yellowstone’s Wolves: A Debate Over Their Role in the Park’s Ecosystem

Earth Day 2024: A Look at 3 Places Adapting Quickly to Fight Climate Change

Millions of Girls in Africa Will Miss HPV Shots After Merck Production Problem

This Lava Tube in Saudi Arabia Has Been a Human Refuge for 7,000 Years

Four Wild Ways to Save the Koala (That Just Might Work)

National Academy Asks Court to Strip Sackler Name From Endowment

Ways Industrial Copper Helps Energy Production

The Ins and Out of Industrial Conveyor Belts